For the first RM100000 is 1 RM1000001 to RM500000 is 2 RM500001 to RM2500000 is 3 RM2500001 onward is 4. Self-employed may want to take advantage of the.

Business Income Tax Malaysia Deadlines For 2021

For instance January contributions must be paid no later than February 15th.

. The nation hasnt seen such a high rate of unemployment since 1993. 2020 was a year that most of us had never experienced before with the impact of the Covid-19. He said that everyone must be able to contribute to the social health insurance fund including the bottom 40 per cent B40 of income earners pointing out that less than 10 per cent of workers in the country pay income tax.

Likewise if you need to estimate your yearly income tax for 2022 ie. So the more taxable income you earn the higher the tax youll be paying. RM 1000000 Gross Chargeable Gain.

These values will differ from calculations provided by the online LHDN PCB calculator. This is because the YTD values are not taken into account in calculating the PCB. Personal financing-i private sector.

With the EPF contribution rate of between 7 to 11 employee and 12 or 13. Consumer guide on reference rate. This is the official alternate procedure provided by LHDN to companies who do not use payroll software or E-PCB.

Order 53 of the Rules of Court 2012 Section 140A Income Tax Act 1967 ITA 1967 Shell People Services Asia Sdn Bhd V Ketua Pengarah Hasil Dalam Negeri. For the first RM100000 is 1 RM1000001 to RM500000 is 2 RM500001 to RM1000000 is 3 RM1000001 onwards is 4. Is giving income tax relief of RM4000 for contribution to EPF and other approved schemes.

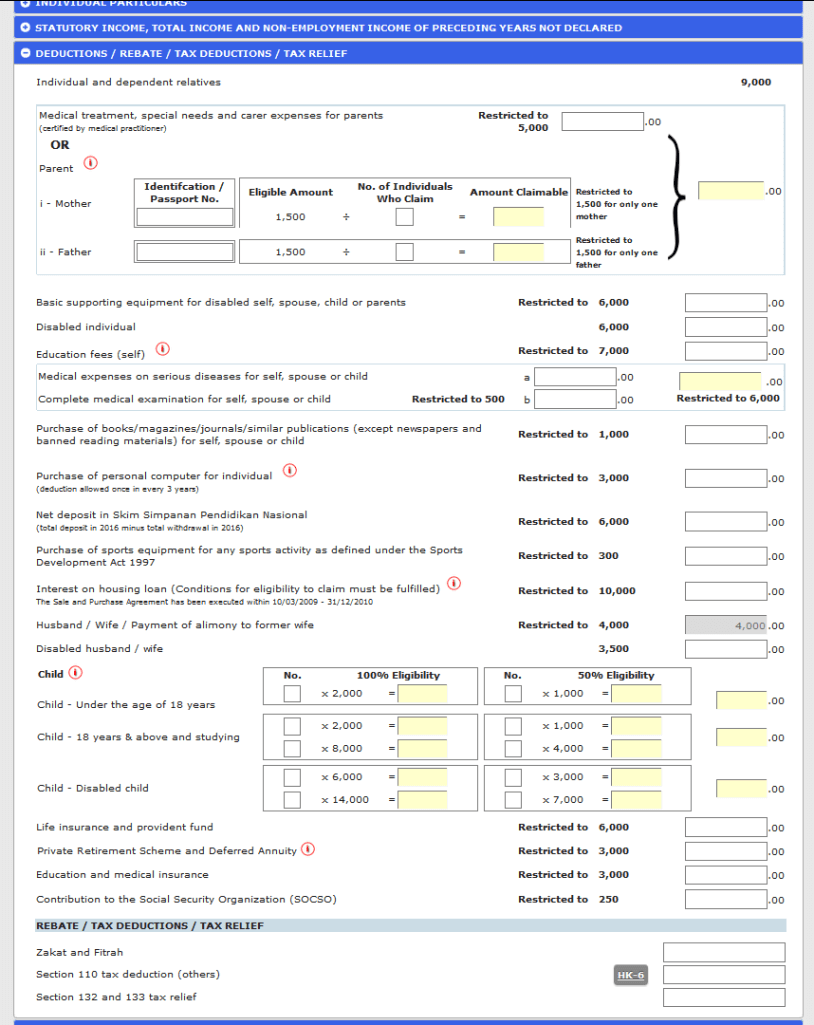

RM 1000000 RM 400000 RM 600000. FOR 2019 TAX RELIEF FOR 2019 TAX RELIEF FOR 2019 DISABLED INDIVIDUAL EDUCATION AND MEDICAL. On the First 5000 Next 15000.

This post has been edited by. Tax Rate of Company. Coming back to the tax exemptions and reliefs these are all the ones that were announced by the government during the 2022 Budget speech.

- Responsible for soil analysis water analysis water quality pumping rate running cost- WTP - Liaise with contractor and consultant if any discrepancy. Official PCB Calculator from LHDN Hasil. Calculations RM Rate TaxRM A.

Interest for late payment of contributions SOCSO 8A will be charged at the rate of 6 per annum for each day of delay in payment of contributions. On the First 5000. LHDN has launched an online payment system e-TT for users to make tax payments.

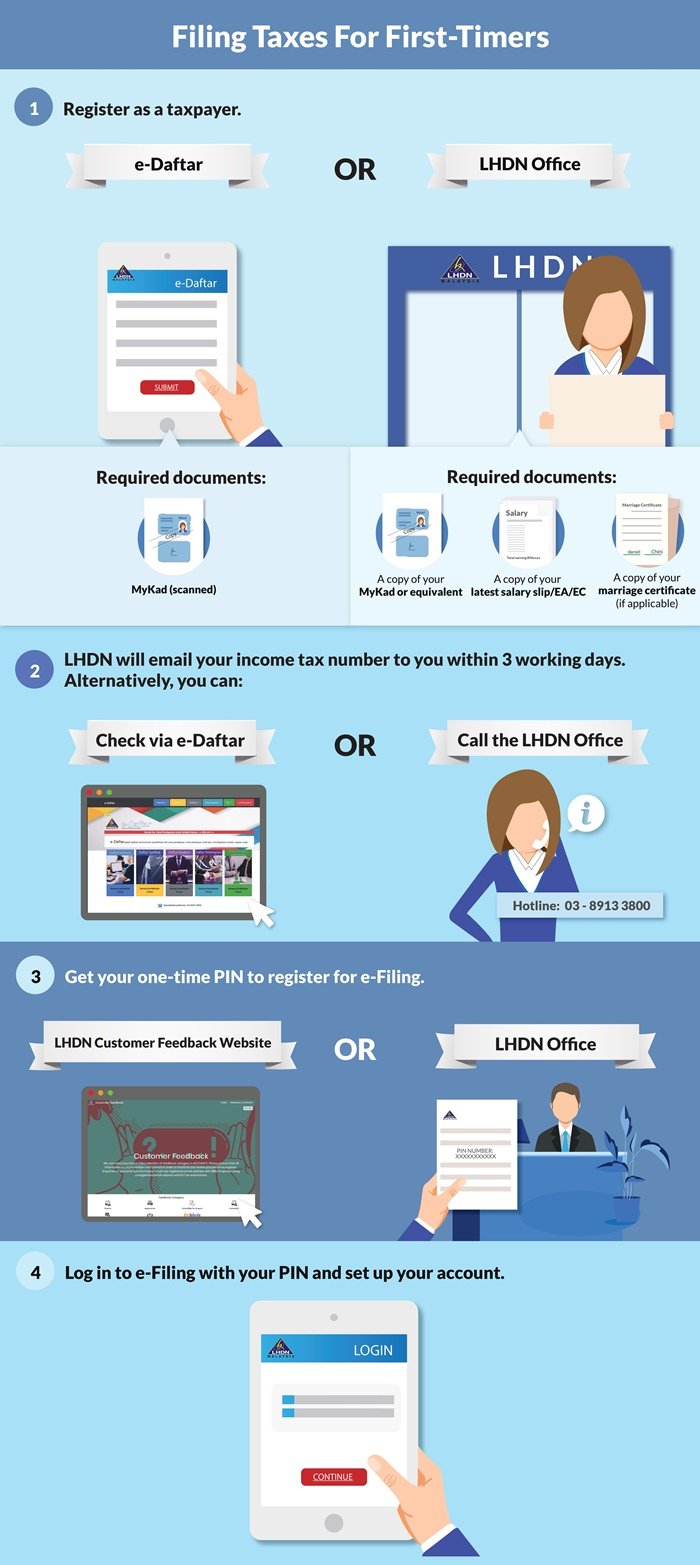

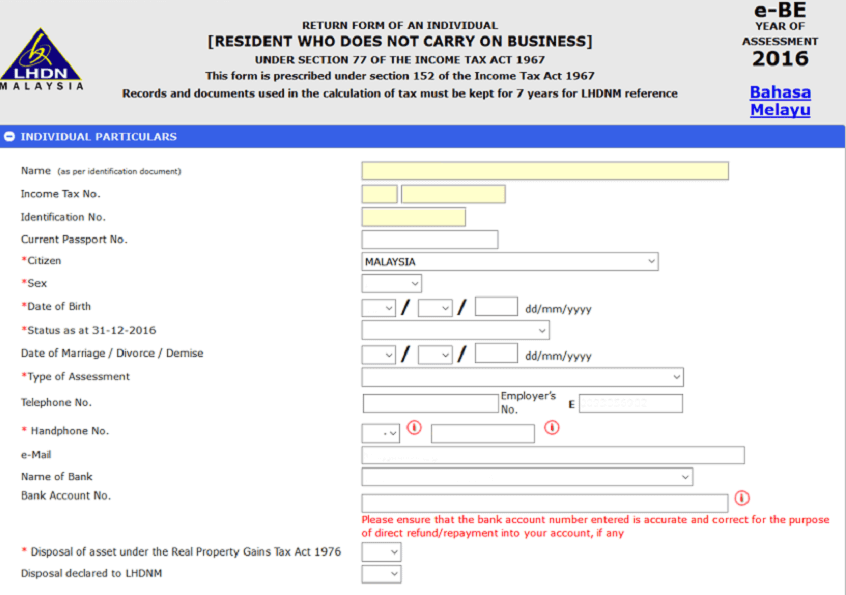

Types of e-Filing user New User First Time User need to register Digital. RPGT Exemptions tax relief Good news. Per LHDNs website these are the tax rates for the 2021 tax year.

If you owned the property for 12 years youll need to pay an RPGT of 5. Assessment year 2023 just do the same as previous step with your estimated 2022 total income but choose 2022 for PCB year. Hire purchase vehicle financing-i warga emas home financing-i.

Here are the income tax rates for personal income tax in Malaysia for YA 2019. TAX PAYABLE RPGT Rate based on the number of years of property ownership x Net Chargeable Gains. Written by iMoney Editorial.

According to LHDN foreigners employed in Malaysia must give notice of their chargeability to the Non-Resident Branch or nearest LHDN branch within 2 months of their arrival in Malaysia. On 31 January 2019 Mr Andrews decided to sell his 100000 shares for RM 1 million to Mr Lodge. If the calculated interest for late payment is less than RM 5 then interest is calculated at the rate of RM 5 per month.

Tax payable Net Chargeble Gain X RPGT Rate based on holding period RM171000 X 5 RM8550. - Coordinate with different trade contractors to ensure efficiency of the project. The stamp duty rates before 30th June 2019 is as below.

In early 2019 I registered myself for EPF i-Saraan previously known as 1Malaysia Retirement Savings Scheme or SP1M. Your tax rate is calculated based on your taxable income. Kalkulator PCB - Lembaga Hasil Dalam Negeri.

Rate TaxRM 0 - 5000 On the First 5000 0 0 5001 - 20000 On the First 5000 Next 15000 1 0 150 20001 - 35000 On the First 20000. Income Tax Act 1967 Withholding Tax-Rate Payment Form. There are some exemptions allowed for RPGT.

Understanding Tax Rates And Chargeable Income. Hire purchase vehicle financing-i an naqlu 1 vehicle financing-i an naqlu 2 vehicle financing-i an naqlu 2 - graduate scheme. E-TT is a system that uses Virtual Account Number VA as.

- Ensure safety at site and all statutory requirements at site is adhered to. By December 2020 about 772900 people lost their job s compared to 510000 the year before. Youll pay the RPTG over the net chargeable gain.

Last year also ended with the Malaysias unemployment rate rising to 48. The stamp duty rates effective 1st July 2019 is as below.

7 Tips To File Malaysian Income Tax For Beginners

Malaysia Personal Income Tax Guide 2021 Ya 2020

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Guide To Using Lhdn E Filing To File Your Income Tax

Lhdn Irb Personal Income Tax Rebate 2022

Ctos Lhdn E Filing Guide For Clueless Employees

Late Filing Of Income Tax Returns New Penalty Rates Lhdn

Personal Income Tax E Filing For First Timers In Malaysia

Malaysia Tax Guide How Do I Calculate Pcb Mtd Part 2 Of 3

Em Han Associates Posts Facebook

Cukai Pendapatan How To File Income Tax In Malaysia

10 Things To Know For Filing Income Tax In 2019 Mypf My

Ctos Lhdn E Filing Guide For Clueless Employees

Em Han Associates Posts Facebook

Download Kwsp Income Tax Relief 2019 Gif Kwspblogs

Individual Income Tax In Malaysia For Expatriates

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia